Jun 12, 2023

Presta Feature: Scoring Loan Applications with Rubrics

Save time and standardize your evaluation practices:

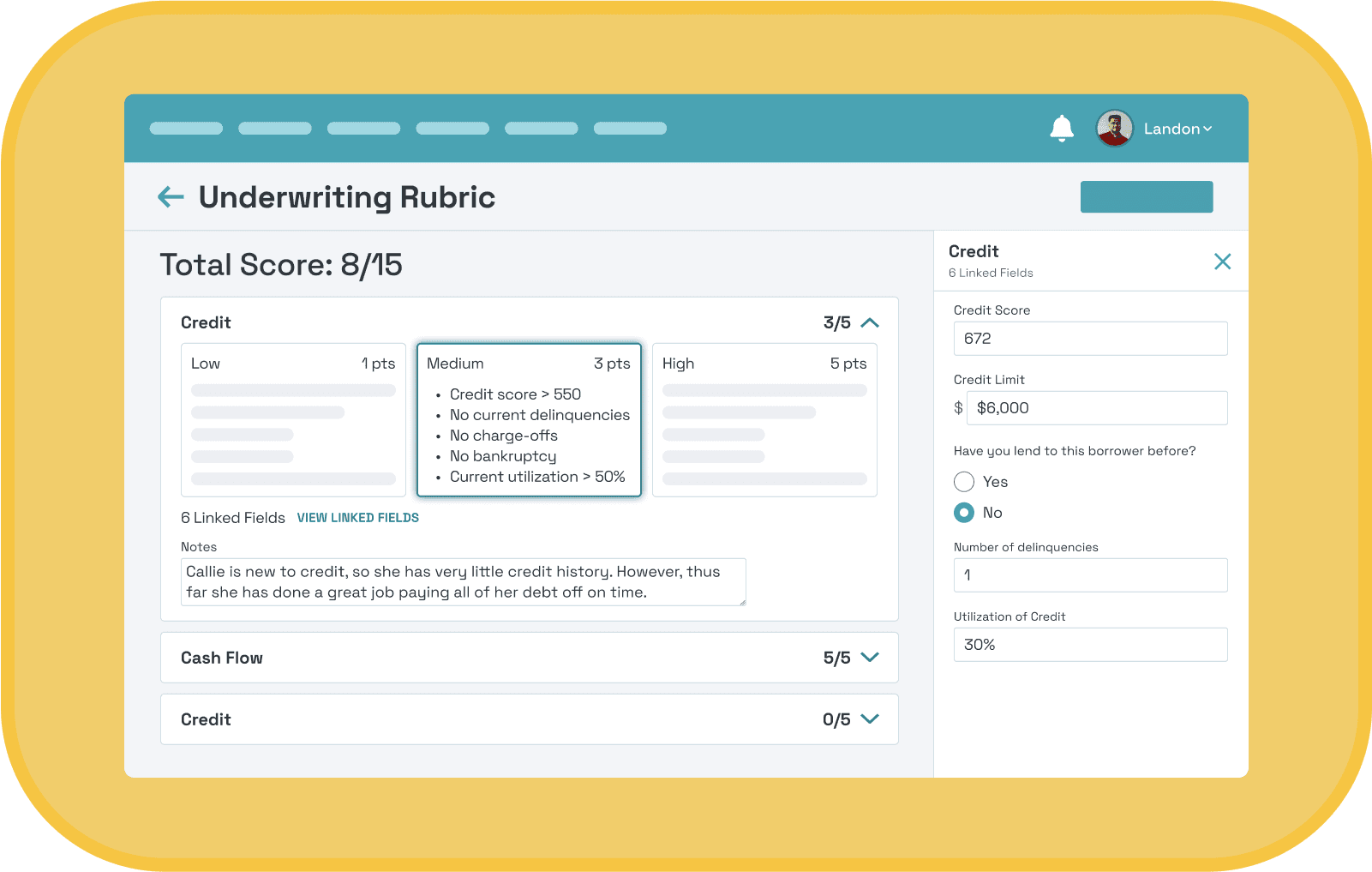

The Rubric Scoring feature offered by Presta is a powerful tool designed to assist lenders in streamlining the underwriting process of loan origination. With this solution, lenders can create custom scoring rubrics tailored to their specific lending criteria and borrower evaluation requirements.

The feature allows you as a lender to define a set of parameters or criteria that are important for assessing borrower and give a numerical rating on any custom creditworthiness criteria you want:

Credit History

Cash Flow

Collateral Value

Borrower Reputation

Industry-specific Factors

(And more!)

Lenders can assign weights or importance to each criterion based on their risk assessment strategy. This flexibility enables lenders to create scoring rubrics that align with their unique lending policies and priorities. Once the rubric is defined, lenders can seamlessly evaluate borrowers against the established criteria. The rubric provides a standardized framework for objectively assessing borrower applications, eliminating subjectivity and ensuring consistent evaluation practices.

Create custom scoring rubrics with more flexibility

Firstly, it enhances efficiency by automating the scoring process, saving significant time compared to alternative evaluation methods. Secondly, lenders can make data-driven lending decisions based on the scores matched up to the rubric crieria, ensuring consistency and minimizing bias. This allows lenders to link relevant information collected during the application to each criteria, so information they need to score the application is easily accessible when they need it.

Additionally, the feature empowers lenders to adapt their scoring rubrics as their lending policies evolve or market conditions change. They can modify or update the criteria, weights, or scoring thresholds to reflect new risk considerations or regulatory requirements. This flexibility enables lenders to maintain a dynamic and responsive underwriting process.

What does this mean for Lenders?

Overall, the Rubric Scoring feature within Presta provides lenders with a customizable and efficient tool to evaluate borrower applications in a consistent and objective manner. It enhances decision-making capabilities, accelerates the underwriting process, and enables lenders to make informed lending decisions based on their specific risk assessment criteria. This feature seamlessly integrates into the Presta platform, allowing you to consolidate all your loan origination needs in one place. This means you can prioritize building meaningful client relationships without the hassle of managing multiple systems.