May 18, 2023

Building a Tailor-Made Lending Workflow

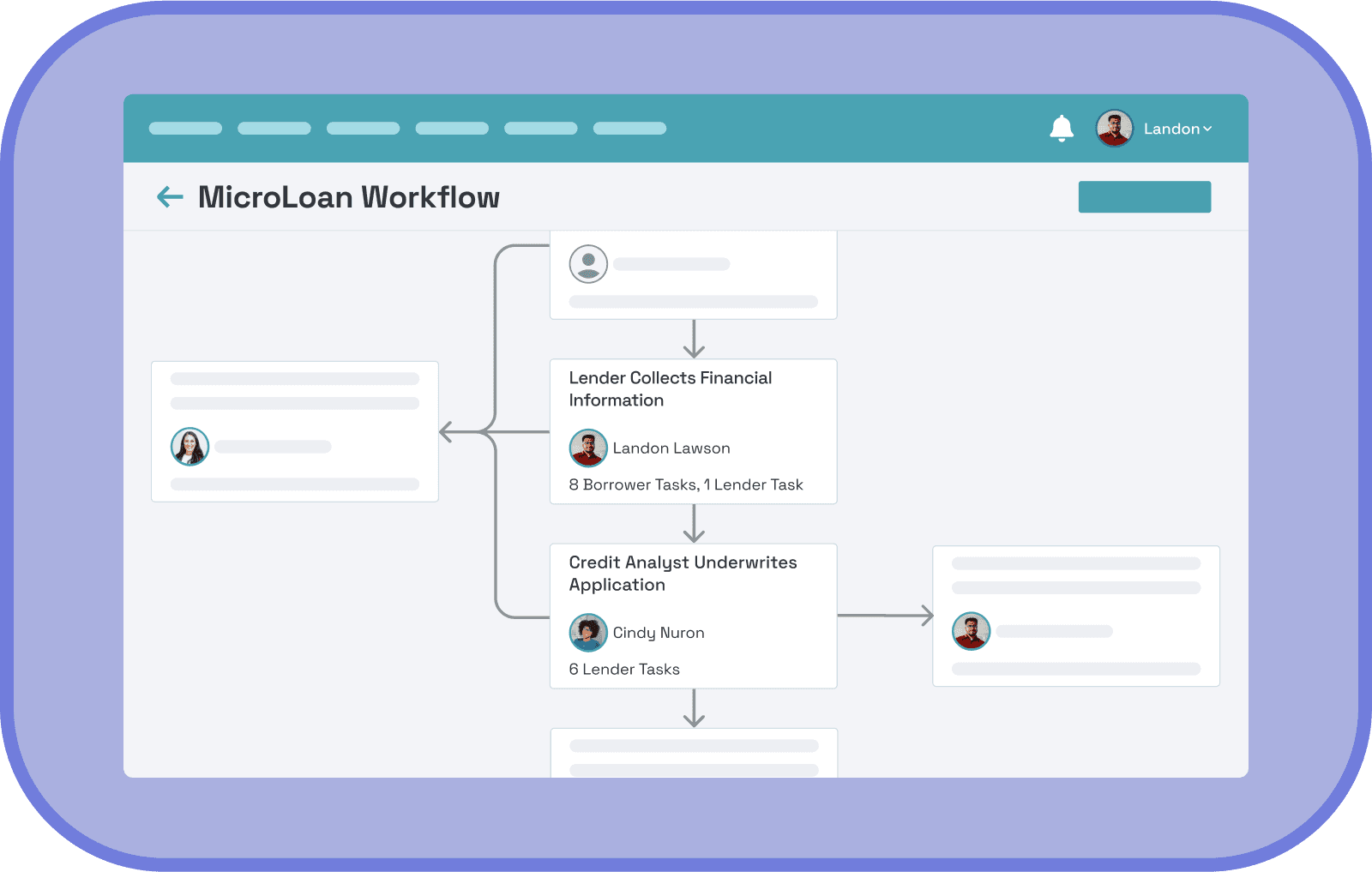

Presta’s custom lender workflow builder is now live!

As a lender, you know that every loan is unique, and each borrower has different needs. However, creating a tailored lending workflow to match these diverse loan types and borrowers can be challenging. That's where Presta comes in. With Presta, you can build a tailor-made lending workflow that matches your lending process, so you can make better lending decisions and serve your borrowers more effectively.

In over 100 interviews with lenders, we have heard the challenges involved with managing different origination processes across the many loan products lenders may offer. We've heard you, and have built Presta to allow you to have customized workflows for each of your loan products

Getting set up with Presta and curating your workflow can help you:

Define and customize specific origination and servicing processes for each of your loan products

Automate your flow for different types of borrowers

Track everything within one central place on Presta

How can Presta’s workflow builder help you simplify and accelerate your loan origination process?

Your loan origination process is built in a customizable format:

With Presta's customizable loan origination process, lenders can automate their lending workflow. The software helps move applicants through the process by prompting them to provide the information needed at each step of the origination process, and highlighting the status of each application item. This also means your flow doesn't have to be linear. Borrowers can progress through different flows based on their business and financial needs. This eliminates back forth, saves time, and keeps the process simple for everyone.

Update your workflow anytime you like:

The admin interface on Presta allows you to make edits to your application documents and process in real time, without the need for software change requests. This allows you to move faster, and have full control over your process as your needs change.

Standardize the way applicants move through the process and standardize the way you can communicate with a borrower:

Once you create your custom flow on Presta it will help you standardize how borrowers move through the lending process and allow you as a lender to communicate with them in a consistent manner. This will improve efficiency and ensure compliance. This can also enable better communication for your team of lenders who can have great visibility into what’s happening at every step through the process.

What’s an example of how a CDFI might use this?

Let's say you're a Community Development Financial Institution (CDFI) that offers several loan products, including microloans, small business loans, and emergency loans. Each loan product requires a different process for risk assessment and underwriting. For example, the microloan program may only require a simple application and credit check, while larger small business loans may require a more extensive review of income and credit history.

In a case like this, perhaps the first two steps of the loan application process are the same for all loan products. However, for the larger small business loan product, you may require additional documentation such as business plans or financial statements. This will bring a borrower through the custom flow you built depending on the borrowers specific lending needs and background.

While this is just one example, you can apply any sort of flow of your choosing you might need for your own organization’s loan process!

How to get started:

If you have any questions or would like to try out Presta just reach out below! By using Presta's customizable loan origination process, you can standardize the way applicants move through the process, while also offering unique loan products to your customers. Additionally, since the tool is in your hands, you can change the process at any time, making it easy to adapt to changes in your lending business. This saves you time and gives you a lot more control over your lending process, allowing you to focus on serving your community.