May 25, 2023

Presta Feature Highlight: E-Signature on Documents

Document signatures should be as simple as clicking a button!

Historically for lenders, obtaining signatures on documents can be a time-consuming process that can cause delays and impede the loan closing process. Traditional methods, such as mailing physical documents or using fax machines, can result in long wait times and the need to track down physical documents. Even digital PDF signatures can still take a lot of time as they often require printing, signing, and scanning. In today's online forward world, lenders need a more efficient way to obtain signatures on important documents.

Quick, easy, and reliable:

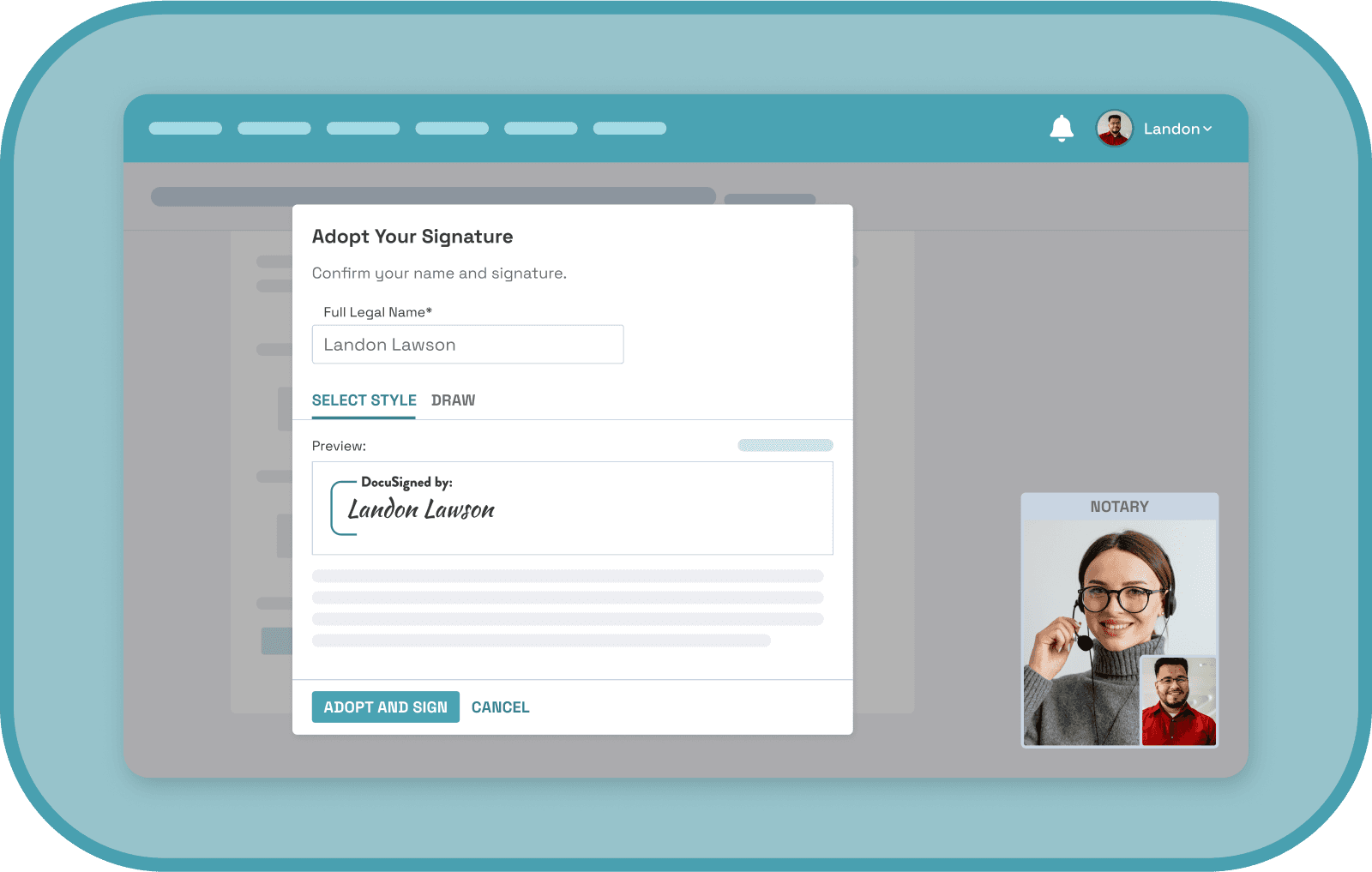

The E-Signature feature in Presta allows lenders to send loan documents to borrowers digitally, eliminating the need for physical copies or faxing. With just a few clicks, borrowers can easily sign and return the necessary documents, saving valuable time and streamlining the loan process.

This enables verified signatures from the borrower right within the Presta platform on the document at hand. Borrower's will receive an email where they can open the necessary documents in Presta and sign electronically using their computer or mobile device. This ensures that all signatures are securely stored and easily accessible within the Presta platform, eliminating the need for back-and-forth communications or the risk of lost documents. Overall, the e-signature feature simplifies the loan process for both lenders and borrowers, making it faster and more efficient for all parties involved.

How would a lender set up this feature within the platform?

Integrating E-Signature on Documents into your lending workflow with Presta is simple and easy. Once you have uploaded the necessary documents for the loan application, you can select the E-Signature feature within the platform. From there, you can choose the parties who need to sign the document. Once all parties have signed, the signed document is saved on the platform and can be viewed by all parties involved. This streamlines the entire process, making it faster and more efficient for both lenders and borrowers.